In today’s complex economic environment, responsible borrowing can make the difference between lasting financial well-being and a cycle of debt. Understanding the fundamentals of smart borrowing, from evaluating loan offers to building healthy credit behavior, is key for individuals striving for financial stability. Whether planning for a significant purchase, managing unforeseen expenses, or seeking debt consolidation, practicing discipline and awareness will set a strong financial foundation. Borrowers should consider options like MaxLend loans, which offer transparent loan terms and flexible repayment plans, helping foster healthy borrowing habits from the outset.

Developing a consistent approach to borrowing—anchored by explicit knowledge and intentional financial choices—allows individuals to navigate loans confidently. This knowledge, paired with a commitment to avoiding high-cost debt and keeping credit utilization in check, helps create a buffer against economic uncertainty and unmanageable debt. Above all, those who master the art of responsible borrowing are poised for more resilient financial outcomes and improved credit profiles over time.

Understanding Loan Terms

Clarity around all aspects of loan agreements is vital. Even the smallest detail, such as the difference between simple and compound interest, can affect the final cost of borrowing. Reputable lenders clearly disclose interest rates, origination fees, late fees, and the repayment schedule. Reading the fine print and asking clarifying questions can prevent surprises down the road. For added convenience, you can apply online with Maxlend Loans, streamlining the process while ensuring transparency. Responsible borrowers calculate the total repayment amount and assess whether monthly payments fit comfortably within their budget, reducing the likelihood of default and financial strain.

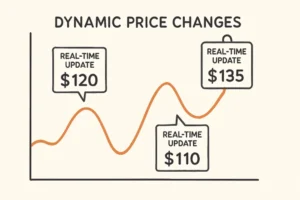

Prioritizing Low-Cost Credit Options

Not all credit is created equal. Borrowers should prioritize products with lower interest rates and predictable terms, such as personal loans for debt consolidation, auto loans through credit unions, or student loans with federal protections. These types of borrowing typically have clearer structures and lower long-term costs than options such as revolving credit card debt. Choosing loans with fixed rates and defined payoff timelines supports disciplined repayment. For instance, refinancing higher-interest debt with a personal loan can reduce monthly outlays and total interest paid over the life of the debt, simplifying financial management.

Avoiding High-Cost Borrowing

High-cost loans, including payday loans, title loans, and certain credit cards, can have annual percentage rates (APRs) exceeding 300%. These products are often marketed as quick fixes but can trap borrowers in expensive debt cycles that are difficult to escape. Instead, seeking out affordable alternatives—even when cash flow is tight—can save thousands in interest and fees over time.

The Role of Financial Literacy

Financial literacy is central to borrowing responsibly. Consumers who understand the impact of interest rates, credit scores, amortization, and budget management are far less likely to fall into debt traps. According to Investopedia, educational initiatives and financial counseling can help individuals assess loan options, compare offers, and make well-informed choices. Making education a regular part of financial planning is essential for both individuals and employers seeking to support employee well-being.

Employer Support in Financial Education

Workplaces are increasingly recognizing the importance of financial wellness programs. By integrating financial education—covering topics like debt management, home buying, and investment basics—organizations empower employees to make sound financial decisions. This, in turn, leads to greater employee satisfaction, reduced absenteeism, and improved productivity. Companies that offer resources, counseling, or access to external experts are not only helping staff but also fostering a more financially secure workforce. Such efforts align with the broader imperative of building stability at both personal and organizational levels.

Implementing Responsible Borrowing Practices

Adopting responsible borrowing habits is a step-by-step process. The following actions help ensure a smooth transition towards better financial habits:

- Carefully assess your current financial standing, including your income, debt expenses, and long-term goals.

- Research and compare loan offers, focusing on annual percentage rates, fees, and company reputations.

- Thoroughly understand each loan’s terms—including interest rates, repayment schedules, and potential penalties—before signing any agreement.

- Create a realistic repayment plan that prioritizes debts with higher interest rates, always ensuring payments can be met without compromising essential expenses.

- Engage with reputable financial education materials, workshops, or counselors to continually refine your debt management skills.

Conclusion

Responsible borrowing is critical to securing and maintaining financial stability, especially in uncertain economic times. By fully understanding loan terms, seeking out affordable credit, steering clear of high-cost lending, and prioritizing financial education, individuals can avoid common debt pitfalls and safeguard their financial futures. As workplaces join the movement by offering supportive resources, the path to stability becomes even more accessible for all. Ultimately, the path to long-term wealth begins with mindful, informed borrowing practices.

Also Read-Why is Student Interest in Tech High?